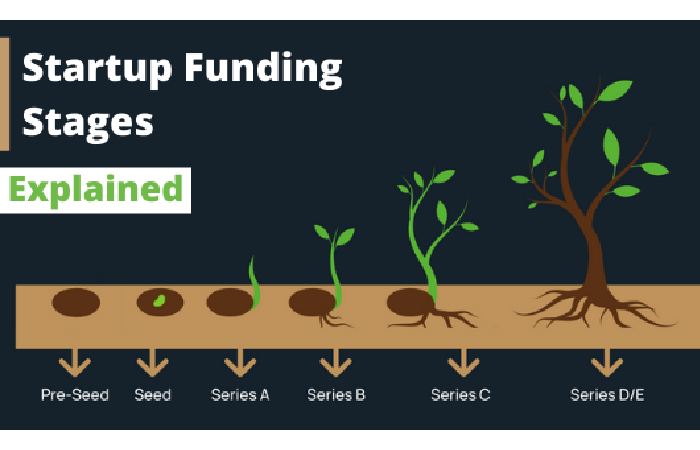

Startup funding refers to raising capital or funds to support the growth and development of a new business venture. It is the money invested in a startup by external investors, typically in exchange for equity ownership or convertible debt.

1. Stages of Startup Funding

1. Seed Funding:

Seed funding is the initial stage of startup funding. In this stage, the company is usually just an idea, and the founders want to build a prototype or a minimum viable product. At this stage, funding is usually provided by friends and family, angel investors, or crowdfunding campaigns.

2. Series A Funding:

Series A funding is the next stage of startup funding. In this stage, the company has developed a working prototype and has established some level of traction in the market. At this stage, funding is typically provided by venture capitalists (VCs) and institutional investors, and also they are willing to invest in companies with a high growth potential.

3. Series B Funding:

Series B funding is the stage where the company has achieved significant growth and is looking to scale its operations. At this stage, funding is usually provided by existing investors, venture capitalists, and private equity firms.

4. Series C Funding:

Series C funding is the final stage of startup funding before the company goes public or is acquired. The company wants to expand into new markets or make strategic acquisitions. Private equity firms and also hedge funds usually provide funding.

Different funding options are available for startups, including equity financing, debt financing, convertible notes, and crowdfunding. Equity financing involves selling ownership shares of the company to investors, while debt financing involves borrowing money from lenders and paying it back with interest.

2. Types of Startup Funding

Self-funding or bootstrapping refers to using personal savings, credit cards, or loans to fund the business.

1. Friends and Family:

This type of funding involves financial support from family members or friends who believe in the business idea. You can ask friends and family to invest in your business. It is a good option if you need a small amount of money to start. However, ensure a clear agreement is in place to avoid misunderstandings later.

2. Angel Investors:

These are wealthy individuals who invest their funds in startups, typically in exchange for equity or ownership in the company. They fund startups in exchange for equity. They can provide expertise and mentorship as well as financial support.

3. Venture Capital:

Venture capitalists are institutional investors who fund startups with high growth potential. In exchange for their investment, they typically take an equity stake in the company and have a say in its run. Venture capitalists (VCs) invest in high-growth startups with the potential to generate significant returns. VCs typically invest larger amounts of money in exchange for a company share.

4. Crowdfunding

involves raising funds from many people, typically via the Internet, in exchange for rewards or equity. Crowdfunding involves raising small amounts of money from many people. It can effectively raise money for your startup, especially if you have a compelling story or product.

5. Accelerators and incubators:

These programs provide funding, mentorship, and other resources to startups in exchange for a stake in the company.

6. Bootstrapping:

Bootstrapping refers to self-funding your startup. It involves using your savings, credit cards, and also personal loans to finance your business. It is the most common way to get started, allowing you to retain control of your business.

7. Grants:

Various government and private organizations offer grants to startups in certain industries or for specific projects. Various grants from government organizations, foundations, and also corporations are available for startups. These grants can provide non-dilutive funding, so you don’t have to give up equity in your company.

Each type of funding has its benefits and drawbacks, and entrepreneurs should carefully consider their options before deciding which one is best for their business.

Conclusion

Startup funding is a critical component of the entrepreneurial journey, and entrepreneurs must carefully consider their funding options to ensure they can achieve their business goals. Before seeking funding, having a solid business plan and pitch deck is important. It will help you communicate your vision and also potential to investors. Networking and building relationships with potential investors can also help you secure funding.

GIPHY App Key not set. Please check settings