Why is Reconciliation Important in Accounting? – Reconciliation is the process of comparing two sets of records to ensure that they agree. In accounting, Reconciliation is used to compare the company’s records with the forms of its bank or other financial institution. Reconciliation helps in recording all the transactions accurately, and it also ensures that there are no errors in the financial statements.

There are many reasons why Reconciliation is important in Accounting. Some of the most important reasons include:

1. To Ensure the Accuracy of Financial Statements:

Financial statements remain based on the company’s records, so it is essential to ensure that they are accurate. Reconciliation can help identify any document errors, which can then remain corrected.

2. To Identify Fraud:

Fraud can occur when someone intentionally records transactions incorrectly. Reconciliation can help to identify any unusual transactions which may be a sign of a scam.

3. To Comply with Regulations:

Many regulations require companies to reconcile their records with the records of their financial institutions. Reconciliation can help ensure that the company complies with these regulations.

Reconciliation is an essential part of the accounting process. By comparing the company’s records with the records of its bank or other financial institution, Reconciliation can help to ensure that all transactions have remained recorded accurately and that there are no errors in the financial statements.

Here are Some Tips for Performing Reconciliation:

1. Choose the Suitable Reconciliation Method:

There are many different methods of Reconciliation. The best way for you will depend on the size and complexity of your business.

2. Set Up a System:

Once you have chosen a method, you must plan to perform Reconciliation. It will help to ensure that the process is efficient and accurate.

3. Be Consistent:

It is essential to be compatible with your reconciliation process to help ensure you compare the same information each time.

4. Keep Records:

You should keep records of all reconciliations. It will help you to track any changes in your documents and to identify any errors.

By following these tips, you can perform Reconciliation effectively and ensure that your financial records are accurate.

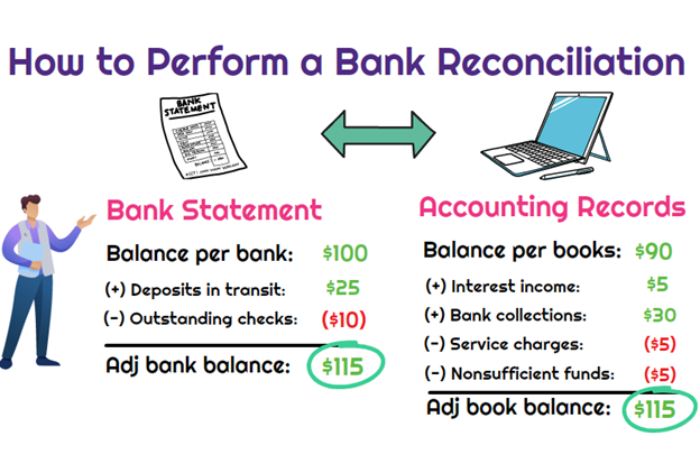

How Reconciliation Works?

In accounting, Reconciliation is used to compare the company’s records with the records of its bank or other financial institution. It helps to ensure that all transactions have remained recorded accurately and that there are no errors in the financial statements.

The reconciliation process typically involves the following steps:

1. Gather the Necessary Information:

This includes the company’s records, such as the general ledger, and the bank’s records, such as the bank statement.

2. Identify the Starting Point:

This is usually the beginning of the reconciliation period, such as the first day of the month.

3. Identify the Transactions During the Reconciliation Period:

It can remain done by reviewing the company’s and the bank’s records.

4. Reconcile the Transactions:

This involves comparing the transactions in the company’s records with those in the bank’s. Any differences should be investigated and corrected.

5. Calculate the Ending Balance:

This is the balance of the company’s account at the end of the reconciliation period.

6. Compare the Ending Balance to the Bank’s Ratio:

The ending balance should be the same as the balance on the bank statement. If the proportions differ, there may be an error in the company’s or the bank’s records.

Reconciliation is an essential part of the accounting process. By comparing the company’s records with the records of its bank or other financial institution, Reconciliation can help to ensure that all transactions have remained recorded accurately and that there are no errors in the financial statements. It can help protect the company from fraud and ensure that it complies.

Conclusion:

Reconciliation is essential in accounting because it helps ensure financial statement accuracy. By comparing the company’s records with the records of its bank or other financial institution, Reconciliation can help identify any document errors. Reconciliation also helps correct these errors. It can help protect the company from fraud and ensure it complies with regulations.

GIPHY App Key not set. Please check settings